We don’t like sacrificing. And with retirement, we don’t want to sacrifice when it comes to the dreams of travel and a comfy life, but we also don’t want to lose out on today – by just saving for tomorrow.

It’s a classic balancing act, can we have our cake and eat it too?

Something that can help with the sacrifice needed today to save for the future, is targeting a goal retirement savings amount. Quite often that’s $1M, $1.5M, or even $2M between a couple. This may be split across super, assets, savings, and more.

So the question then becomes, how long will $2 million last in retirement in Australia?

Knowing how much you need to save is a great way to set yourself up for an enjoyable retirement, but it also means you can save effectively today with the knowledge the hard work will pay off.

This article aims to address the question of how long $2 million will last in retirement in Australia. We will explore various factors including super, living expenses, taxes, and flexibility in an attempt to provide a comprehensive analysis.

Is $2 Million enough to retire in Australia?

In Australia, the Association of Superannuation Funds of Australia (ASFA) provides guidelines for retirement budgets.

According to ASFA’s Retirement Standard, a comfortable retirement for a single person requires around $49,462 per year, while a couple needs approximately $69,691 annually. These figures encompass essential needs, leisure activities, and occasional travel.

If each person in the couple lives for 27 years of retirement, at this average figure then they’d need close to $1.9M for retirement before taking into consideration inflation over the years until retirement, and during the period.

27 years is the length of time between the average retirement age in Australia, and the current life expectancy.

So $2M in retirement savings could be enough to retire on if you kept living expenses and your standard of living at a level of comfort considered essential by the ASFA.

Want to see what an example retirement plan? Click the link below

Is $2 Million in Super enough?

While it can be interesting to reflect on what the average person needs for a comfortable retirement the best guide is to look at what you have been spending to date.

Once you have that understanding, back out any big ticket expenses like mortgage repayments and private school fees (assuming they have finished by retirement) and add any new expense line items you might want given more time on your hands (such as for travel).

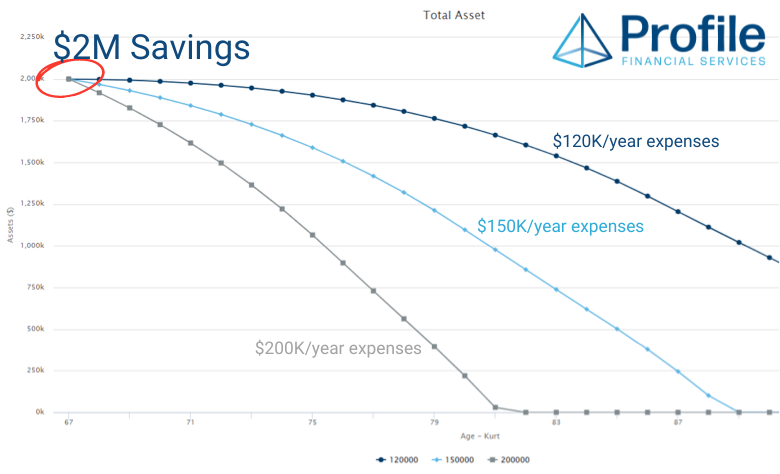

Working out how long $2M super will last in retirement is predicated on what your expenses will look like. The table below provides an overview of three different yearly spending scenarios.

The above chart shows that with living expenses of $120,000 you shouldn’t have any worries about running out of retirement capital or super savings.

However, if expenses increased to $150,000 things are starting to get questionable, especially if a few big unplanned expenses come up or you have great longevity.

With living expenses of $200,000 it is going to be important that you have a Plan B in place, such as downsizing the home at some stage.

A lot of people consider a 2-stage spending pattern in retirement thinking they will spend a lot early on with extra travel and as they get older this will stop. While reduced travel may be a reality a lot of the time this does not result in lower spending levels due to increased medical, home care and other assistance costs that tend to appear in the mid to late years of retirement.

Keep in mind that if you are spending your annual budget each year you may well run out of funds sooner than you have planned.

Irregular Expenses in Retirement

Life continues even though you might have slowed down. A lot of people incur quite significant expenses on an irregular basis during retirement that cannot be exactly planned for. But you can work on anticipating these in advance.

Some of the more common irregular expenses we have observed are:

-

- car updates

- helping children with home deposits

- children’s weddings

- children’s divorces

- out of pocket medical expenses.

Taxes and Superannuation in Retirement

Australia’s superannuation system plays a crucial role in retirement planning.

Withdrawals from superannuation are generally tax-free for individuals aged 60 and above. Earnings within the superannuation environment are either taxed concessionally (15%) while in accumulation phase or tax-free once used to commence an account based pension.

$2million in investment capital split between a couple in the tax-free pension environment is far more valuable than if the exact same investments are held personally.

If your $2 million of investments (split between both of your pension accounts) are earning 6%pa, that is $120,000pa that you have available to spend before you are drawing down on capital.

If you hold those same investments personally (in joint names) there is only going to be $97,866 left after you have paid $22,134 of income tax between you (based on 2022-23 tax rates). This will mean you will need to spend less or draw harder on your investment capital to receive the same amount to spend.

If a couple could live off of $120,000 per year, then they could potentially go their entire retirement just living off of interest, and have $2million of investments to leave for their family.

Investment Strategy during Retirement

The investment strategy adopted during retirement significantly impacts the duration of $2 million.

Conservative investment options such as cash and fixed deposits offer some stability but may not provide sufficient growth to combat inflation and living expenses over an extended period.

On the other hand, investing in growth-oriented assets like stocks or real estate carries more risk but has the potential for higher returns over the long term.

Balancing risk and return based on individual circumstances, risk tolerance and required rates of return is crucial.

The type of investments you choose can have a big impact on the cash and flexibility they can provide. This is particularly important when your plan has you drawing down on your investment capital over time.

While property can be a great investment to accumulate wealth, it can be far less effective at funding your retirement needs – especially if you only have 1 or 2 properties and very little other investment reserves. This is because if the net rent is not meeting your living expenses you cannot just “sell the bathroom” to fund your upcoming new car purchase.

In comparison, other investments such as shares and managed funds are far easier to access small parcels of the capital – for example if the dividends from your share portfolio are not meeting your income needs you can sell a handful of shares.

Is $1 Million super enough to retire on?

You can begin to work out if $1 Million in super or retirement savings is enough for you to retire on if you can apply the same workings and thoughts that we’ve discussed in this article.

Namely, what age you want to retire, how long would you expect to be retired for, and what your expected yearly expenses would be.

If you were to be retired for 27 years (the average for an Australian), without taking into account any further income streams, inflation, and other factors, dividing $1,000,000 by 27 years would leave you with a yearly figure of just over $37,000 in expenses.

This is a very early figure for your planning, and with any financial planning it is highly recommended to see a qualified financial adviser.

Conclusion

$2 million can provide a substantial foundation for retirement.

However, several factors are going to influence if it will last long enough for you. Your living expenses, taxes, and investment strategy are all going to have a big impact.

It’s crucial to consider individual circumstances, including desired lifestyle and personal expectations, while accounting for unexpected expenses and inflation.

Seeking professional financial advice is invaluable for tailoring a retirement plan that looks to optimise the longevity of funds and help you work towards a comfortable retirement. Remember, proper planning today can lead to a worry-free tomorrow.

* Assumptions made – Couple aged 67, $1million each in superannuation pension accounts earning 6%p.a, own their own home, living expenses indexed with CPI of 1.9% annually.