What are goals?

Goals are the things that are important to us and what we strive for. When discussing goals in the context of finance, many people may wonder why do I need to worry about goals, isn’t making money the goal?

This was the goal of traditional financial planning but for a variety of reasons this has been superseded by the concept of Goals Based Financial Planning. Goals may be thought of as the things that we strive to achieve in our working or personal lives. Sounds easy but identifying our goals may sometimes be not so straightforward, especially long-term goals, and the answer tends to change over time.

The idea of Goals Based Financial Planning is to work with people to dig deeper and identify our goals and recognise why they are important to us. Once this is done, we need to prioritise these goals, as achieving everything is not possible therefore its important to recognise the reality that we may have restrictions on what is achievable.

Why do goals need to be SMART?

Anyone who has sat in a corporate planning session will know all about making goals SMART! Making our personal and financial goals SMART is also important. Setting a goal of retiring comfortably sounds great but what does that mean and how do we know if we are on track to achieve it. This is where Goals Based Financial Planning can help to flesh out the details.

Something along the lines of ‘I want to retire at age 60 and need $50,000 per year to pay the bills and put food on the table for 25 years’ is a goal with timelines and targets to assess progress along the way. Breaking goals down may also be a helpful way of making things feel more achievable. ‘I will save $100,000 in 5 years for a house deposit’ may feel less daunting than ‘I need to spend $500,000 to buy an apartment’.

These examples are financially focused but other types of goals may be possible. For example, ‘I want to spend more time with my children’. This could be complemented by ‘I want to be working 4 days per week by 2026 and earning 100% of my existing salary’.

Prioritise and action your goals

Now I have identified my goals lets get working on them! Unfortunately, things are never that simple. An important step in Goals Based Financial Planning is to prioritise our goals and financial planners can create plans and hold people accountable to agreed actions. This step recognises we may have financial or other restrictions to achieving our goals. Some may be more personal and don’t require financial advice or others may need significant behavioural change to be achievable. Plus, life happens so goals and plans need to be flexible to adjust to realities.

How can a financial plan help you achieve your goals?

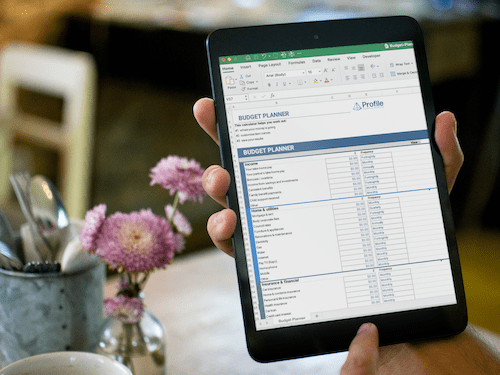

A plan to reach a goal may require a lot of work to change our behaviour to money and set up structures to implement things like a savings plan. We may stray from the path sometimes, but this is where Goals Based Financial Planning may help us get back on track by regularly assessing how we are going and identifying if the goal needs to be adjusted or if we need a nudge in the right direction.

Flexibility when planning is essential

It is important for us to be held accountable to our plans to achieve goals but sometimes things happen that may prompt us to reassess our goals. This is a reality of life that Goals Based Financial Planning needs to recognise. If our goals change then the plan to achieve them will need to change also. Resetting the direction may not mean throwing the baby out with the bathwater though. The progress already made could still be incorporated into the new plan.

Where do I start?

You could call to speak to a financial adviser at Profile Financial Services, but before that why not take some time to think about what is important to you and your family. Think about where you are now and where you would like to be in 10 years’ time. Then try setting some milestones for 3 years with actions to implement now to start the journey. You may not need help with some of these goals but for others, Goals Based Financial Planning can be a valuable investment of time and money in your family’s future.

To stay up-to-date with our latest articles, industry updates and more, simply follow our Facebook or LinkedIn pages.